Market Focus

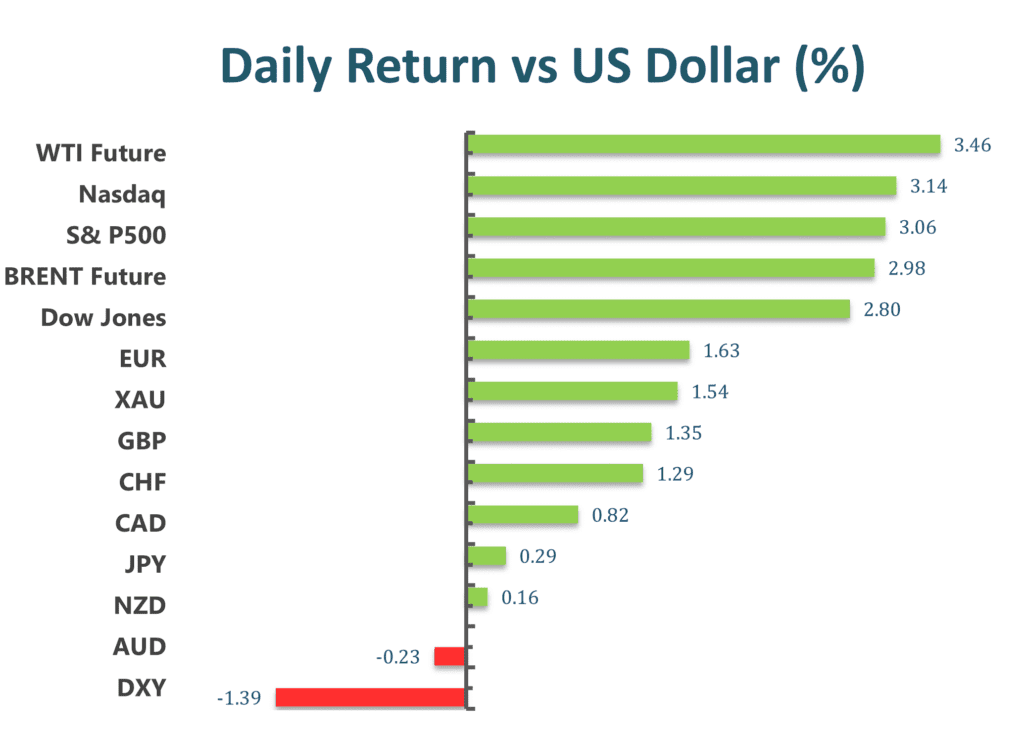

US equity markets continued to rise over the course of yesterday’s trading. The Dow Jones Industrial Average climbed 825.43 points to close at 30316.32. The S&P 500 rose 3.06% to close at 3790.93. The tech-heavy Nasdaq Composite rose 360.98 points to close at 11176.41. Over the past two days, equities have posted one of their best two-day streaks since the beginning of the year. The short term relief rally was further aided by the downbeat US PMI data release and a weaker job openings figure. Market participants are now banking that weak economic data releases will deter the Fed from further aggressive rate hikes. However, market participants should be aware that the global markets are still deep in bear market conditions and inflation is still bearing on prices, thus a dovish surprise from the Fed should be taken with a grain of salt.

The US 10 year Treasury yield was last seen trading at 3.629%.

Twitter shares were halted for trading during yesterday’s American trading session as Tesla CEO Elon Musk has decided to go through with his original purchase offer. Shares of Twitter surged 22.24% at the bell to close at $52 a share—Elon Musk has offered to buy out Twitter at $54.2 a share.

On the economic docket, US ADP nonfarm employment change and non-manufacturing PMI data are set to release during today’s American trading session.

Main Pairs Movement:

The Dollar Index continued to retreat for the second day in a row. The benchmark index lost 1.31% as Treasury yields retreated and equities rallied. The weaker than expected US job openings figures have also acted as headwind for the US Greenback. Market participants are now hoping that weaker macro-economic data will decrease the pace of tightening by the Fed.

EURUSD continued to rise as the Dollar weakened. ECB President Christine Lagarde’s speech on Tuesday offered little direction for markets. On Thursday, the ECB is set to announce its monetary policy meeting minutes.

GBPUSD advanced 1.34% over the course of yesterday’s trading. The British Pound has recovered more than 7% since touching its all time low on September 26th. The British government’s reversal on tax cuts have eased market concerns, aiding the Pound’s recovery.

XAUUSD climbed 1.57% over the course of yesterday’s trading to close at $1726 per ounce.

Technical Analysis:

EURUSD (4-Hour Chart)

The EUR/USD pair advanced on Tuesday, preserving its bullish momentum and extending its daily rally towards the 0.9900 area amid the risk-on market sentiment. The pair is now trading at 0.9829, posting a 0.28% gain on a daily basis. EUR/USD stayed in the positive territory amid renewed US dollar weakness, as the falling US Treasury bond yields continued to weigh on the safe-haven greenback and lifted the EUR/USD pair higher. On the economic data side, the US JOLTs Job Openings declined more than expected to 10.1 million in August, showing that the aggressive rate hikes by the Federal Reserve started to impact the economy as the US central bank scrambles to tame inflation. For the euro, the European Central Bank (ECB) President Christine Lagarde said on Tuesday it was difficult to say whether or not inflation has peaked in the euro area.

On the technical side, the RSI is at 71, suggesting that the pair is facing heavy buying pressure as the RSI reached the overbought zone. As for the Bollinger Bands, the price moved out of the upper band so a strong upside trend continuation can be expected. In conclusion, we think the market will be bullish as the pair is heading to test the 1.0035 resistance. The rising RSI also reflects bull signals.

Resistance: 1.0035, 1.0155

Support: 0.9880, 0.9765, 0.9664

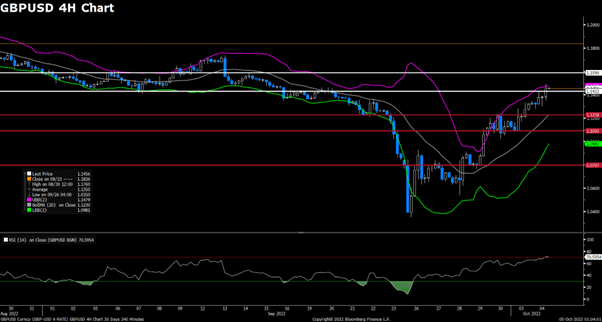

GBPUSD (4-Hour Chart)

The EUR/USD pair advanced on Tuesday, preserving its bullish momentum and extending its daily rally towards the 0.9900 area amid the risk-on market sentiment. The pair is now trading at 0.9829, posting a 0.28% gain on a daily basis. EUR/USD stayed in the positive territory amid renewed US dollar weakness, as the falling US Treasury bond yields continued to weigh on the safe-haven greenback and lifted the EUR/USD pair higher. On the economic data side, the US JOLTs Job Openings declined more than expected to 10.1 million in August, showing that the aggressive rate hikes by the Federal Reserve started to impact the economy as the US central bank scrambles to tame inflation. For the euro, the European Central Bank (ECB) President Christine Lagarde said on Tuesday it was difficult to say whether or not inflation has peaked in the euro area.

On the technical side, the RSI is at 71, suggesting that the pair is facing heavy buying pressure as the RSI reached the overbought zone. As for the Bollinger Bands, the price moved out of the upper band so a strong upside trend continuation can be expected. In conclusion, we think the market will be bullish as the pair is heading to test the 1.0035 resistance. The rising RSI also reflects bull signals.

Resistance: 1.0035, 1.0155

Support: 0.9880, 0.9765, 0.9664

XAUUSD (4-Hour Chart)

The XAU/USD has surged 3.67% this week as of writing, which is mainly due to the dramatic retreat of the US dollar from a 20-year high. The Bank of England’s willingness to buy up to £5 billion of long-dated gift drags the US bond yields away from a multi-year top and continues to weigh on the greenback. Moreover, growing fears about a deeper economic downturn in the US and Europe offer additional support to the safe-haven yellow metal. Disappointing US data on Monday undermined the worries, which showed that manufacturing activity grew marginally in September at its slowest pace in nearly 2 years. To a large extent, these offset the risk-on mood and do little to dent the prevalent bullish sentiment surrounding gold. However, a more aggressive policy on hiking interest rates could act as a headwind for the non-yielding gold.

On the technical side, the RSI indicator is at 71, implying a bullish outlook in the near term. For the Bollinger Bands, the price witnessed fresh buying and moved along with the upper band, which indicated a sustain of the upside trend can be expected. The strong follow-thrugh positive move lifted the XAU/USD to a three-week high, around the $1,710 region during the first half of the European session on Tuesday.

Resistance: 1802, 1763

Support: 1660, 1644, 1620