Market Focus

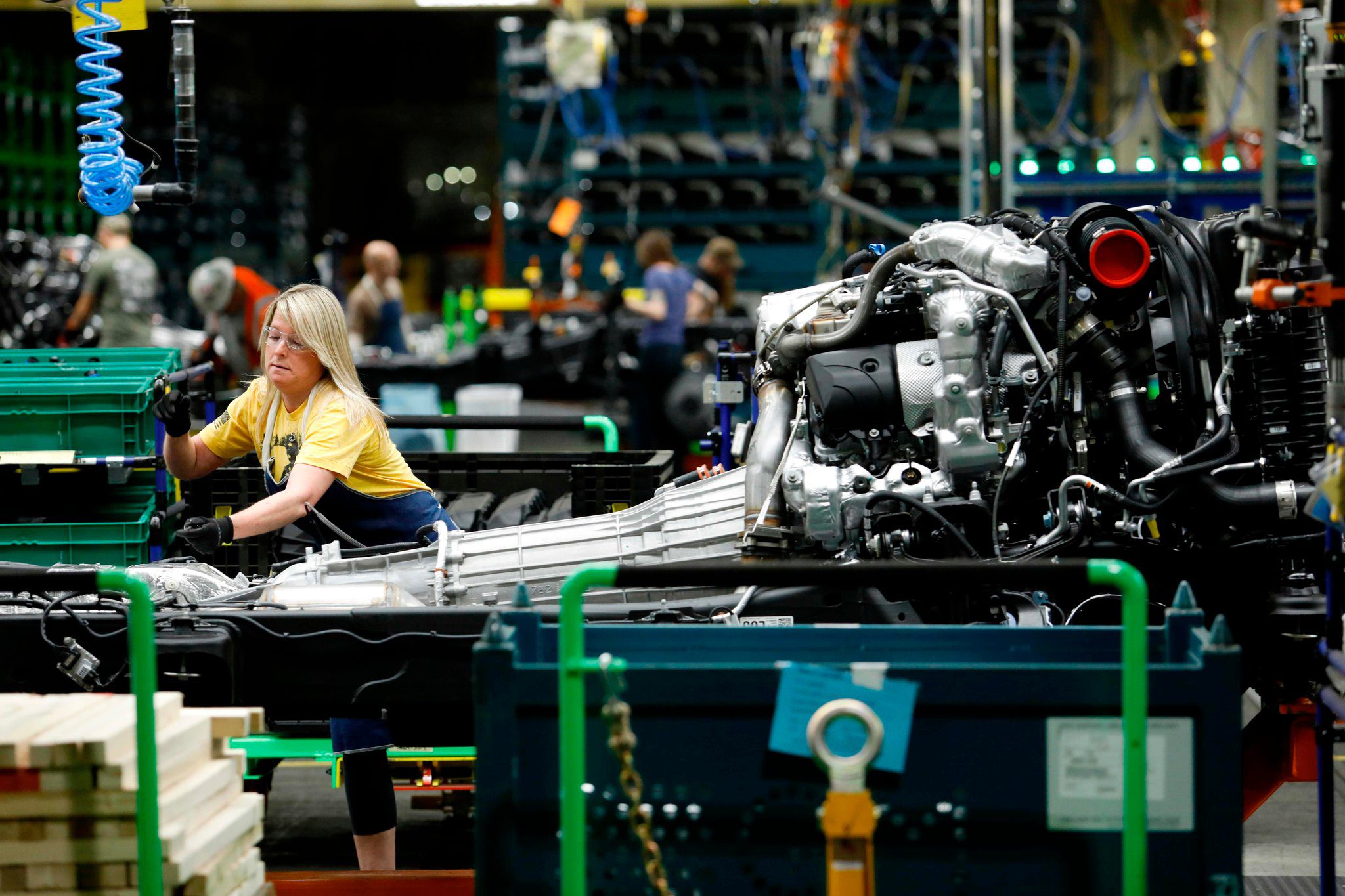

US shares advanced on Friday and recovered some of the ground lost on Thursday as the late-day rebound might be increased by low volume ahead of Monday’s holiday. The risk of a renewed selloff in equities is still high due to the pessimistic growth outlook, as investors are worried that the tighter monetary policy in the face of higher inflation will lead to economic growth slowing and a possible recession. On the economic data side, the Institute for Supply Management’s US manufacturing PMI fell to 53 from 56.1 in May, which was the weakest since June 2020 and showed that the manufacturing activity in the US has weakened as new orders contracted. The market focus has now shifted to this week’s Federal Reserve June meeting minutes, as the central bank is expected to raise interest rates by 75 basis points.

The benchmarks, S&P 500, Nasdaq 100 and the Dow Jones Industrial Average all rose on Friday despite the safe-haven US dollar advancing on recession fears. Nasdaq 100 was up 0.7% on a daily basis and the Dow Jones Industrial Average also advanced 1.0% for the day. All eleven sectors stayed in positive territory, with the utilities and consumer discretionary sectors performing the best performing among all groups, rising 2.48% and 1.97%, respectively. The S&P 500 climbed the most with 1.1% gain on Friday and the MSCI World index rose 0.5%. For the week ahead, Nonfarm Payrolls will be the key data that might provide fresh impetus.

Main Pairs Movement

The US dollar advanced on Friday, rebounding from the 104.7 level that it touched on Thursday and extended its rally toward the 105 area amid risk-off market sentiment. The DXY was surrounded by bullish momentum during the first half of the day and reached a daily high near 105.6 level in the early US session, but then lost its bullish traction to surrender some of its daily gains. The safe-haven greenback continues to find demand amid escalating fears about a global recession, as the dismal US manufacturing PMI fueled recession-related concerns.

GBP/USD tumbled 0.70% on Friday amid the stronger US dollar across the board. Increased appetite for safe-haven assets weighed on the GBP/USD pair. Cable remained under bearish pressure and dropped to a monthly low below the 1.199 mark, but then regained some upside traction to recover its daily losses. Meanwhile, EUR/USD slumped to the lowest level since June 15th, below the 1.038 level. The pair was down almost 0.50% for the day.

Gold rebounded slightly after touching a daily low below $1786 in the late European session, as US Treasury yields collapsed and provided support to the precious metal amid fears of a recession. Meanwhile, WTI oil climbed back to $109 despite the escalating recession fears.

Technical Analysis

EURUSD (4-Hour Chart)

EURUSD traded 0.54% lower over the course of the last trading day of the week. The Eurozone HICP, harmonised index of consumer prices, jumped to 86% in May, coming in higher than the 8.3% expectations. Despite the ECB’s efforts to tame inflation, prices are still growing at a pace that threatens price stability. The Greenback continues to be on the rise as market sentiment continues to be risk averse and the U.S. equity market continues to fall further into bear territory. U.S. PMI data came in at 52.7, compared to estimates of 52.4, showing a growth in purchasing and still signs of a healthy economy.

On the technical side, EURUSD was able to recover from our previously estimated support level of 1.0382 despite falling below this level briefly. A new level of resistance has formed around the 1.0485 price region. RSI for the pair sits at 41.02 as of writing. On the four hour chart, EURUSD is currently trading below its 50, 100, and 200-day SMAs.

Resistance: 1.0485, 1.05754

Support: 1.0382

GBPUSD lost 0.68% over the course of the last trading day of the week. The pair gave up gains from the previous day as demand for the U.S. Greenback resumed. The Dollar index, which measures the U.S. Dollar against a basket of other major foreign currencies, gained 0.36% to close the week in the green. The U.S. PMI data, which was released during the American trading session, provided fresh optimism for the U.S. Dollar as the figure came in better than expected.

On the technical side, GBPUSD successfully defended our previously estimated support level of 1.20824, despite the pair trading below that level for a brief period during the late European trading session. RSI for Cable sits at 38.1, as of writing. On the four hour chart, GBPUSD is currently trading below its 50, 100, and 200-day SMAs.

Resistance: 1.2381

Support: 1.2123, 1.20824

USDJPY (4-Hour Chart)

USDJPY retreated a further 0.31% over the course of the last trading day of the week. After touching a 24 year high on the 29th, USDJPY has been on a two day short term correction. However, as the U.S. reported better than expected PMI figures, demand for the U.S. Greenback returned towards the end of the American trading session. Carry trade opportunities continue to exist between these two currencies and are expected to increase as the better PMI provides more confidence for the Fed to hike interest rates by the next FOMC meeting.

On the technical side, USDJPY retreated from our previously estimated resistance level of 136.57 and successfully defended our estimated support level at 134.6. RSI for USDJPY sits at 58.39, as of writing. On the four hour chart, USDJPY is currently trading above its 50, 100, and 200-day SMAs.

Resistance: 136.57

Support: 134.6