Market Focus

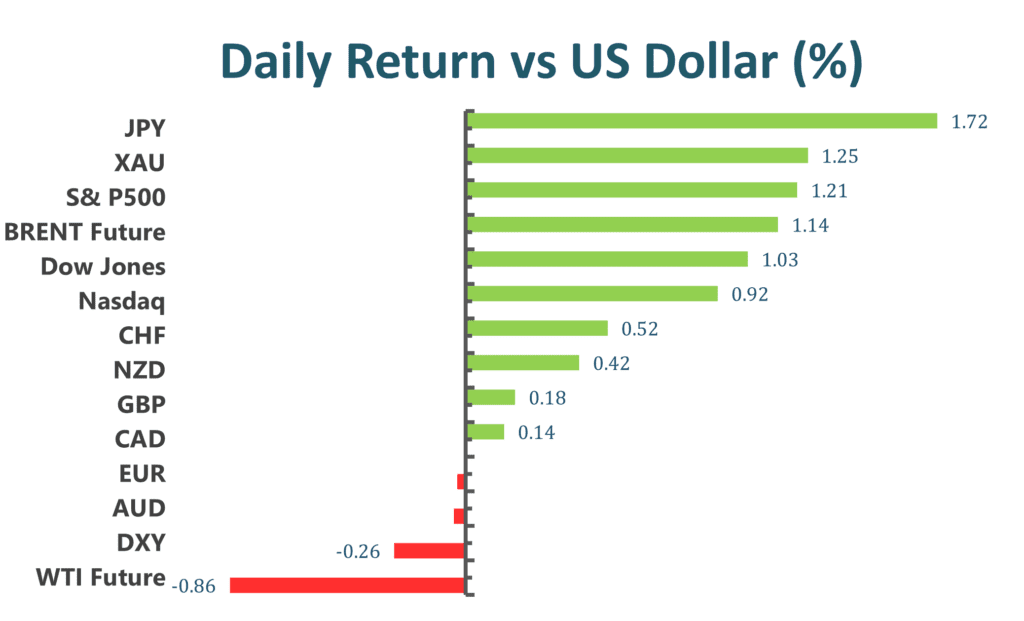

US stocks surged on Wednesday, regaining upside momentum and made a big comeback amid Fed chairman Jerome Powell’s less hawkish comments after the central bank’s monetary policy decision. The US Federal Reserve on Wednesday announced that it had lifted the main benchmark rate by 75 bps to the range of 2.25-2.5%, which came in line with the market expectation and exerted heavy bearish pressure on the US dollar. Moreover, Powell rejected speculations that the US is in recession in the press conference, as he said the Fed is moving expeditiously when dealing with inflation. Powell’s comments have cooled recession fears and acted as a tailwind for the equity markets. In the Eurozone, commentary from a German gas regulator Klaus Meuller has escalated the fears of an energy crisis, as he said that energy prices could accelerate further dramatically due to the gas supply cut off from the main pipeline from Russia.

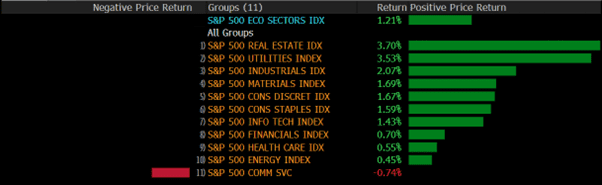

The benchmarks, S&P 500 and Dow Jones Industrial Average both advanced on Wednesday as about 85% of the S&P 500 companies rose and the Nasdaq 100 witnessed the best one-day rally since November 2020. The S&P 500 was up 2.6% on a daily basis and the Dow Jones Industrial Average also advanced with a 1.4% gain for the day. All eleven sectors stayed in positive territory with the Communication Services and the Information Technology sectors the best performing among all groups, rising 5.11% and 4.29%, respectively. The Nasdaq 100 meanwhile climbed the most with a 4.3% gain on Wednesday, while the MSCI World index rose 1.9% for the day.

Main Pairs Movement:

The US dollar declined on Wednesday, following the US Federal Reserve interest rate decision. The central bank hiked the main benchmark rate by 75 bps as expected. The DXY index dropped to a daily low level below 106.4 after the FOMC Press Conference. Besides the monetary policy announced by the Fed, it is also worth noting that the markets reacted to Jerome Powell’s speech, where he does not see the economy currently in recession and tried to cool down recession fears. The next closely-watched event will be the preliminary estimate of the US Q2 Gross Domestic Product on Thursday.

GBP/USD surged 1.08 % on Wednesday amid a weaker US dollar across the board. The decision of back-to-back 75bps rate hikes, as well as slower production and spending in the US, have been perceived by investors as “slightly dovish”. The British pound went up to a daily high level above 1.218 after the FOMC meeting. Meanwhile, EUR/USD also reached a daily high level above 1.022. The market temporarily put aside concerns of an escalating energy crisis, and Cable advanced 0.82% for the day.

Gold edged higher with a 0.98% gain on Wednesday as mild commentary delivered by Fed and reached a daily high above the $1740 mark. Meanwhile, WTI regained bullish momentum and reached a daily high above the $97.6 area.

Technical Analysis:

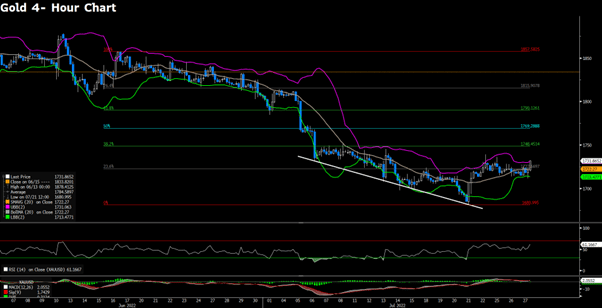

XAUUSD(4-Hour Chart)

Gold climbed above 1720 as an initial reaction to the US Fed raising interest rates by 75 basis points as expected. On the technical side, gold is still trading in the tight range above and below 1722. In the meantime, gold remains near the midline of the Bollinger band, showing its directionlessness. However, the RSI indicator at the moment skews to the upside, suggesting that the near-term outlook has turned bullish. To the downside, if gold falls below 1722, then its momentum would turn bearish as it would trade within the lower bounce of the Bollinger band.

Resistance: 1722, 1748, 1769

Support: 1680.99

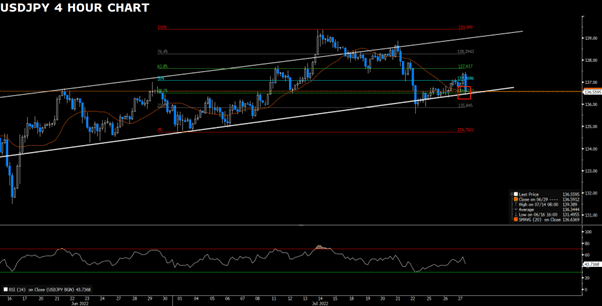

USDJPY (4-Hour Chart)

USDJPY lost traction as the Fed signaled that it could slow the pace of rate hikes. From the technical perspective, despite its downward price action, USDJPY remains bullish as it stayed within the ascending channel as well as the 20 Simple Moving Average. As long as USDJPY can stay above 136.52 and the bullish channel, then the outlook of the pair remains upside. On the flip side, a breakout of 136.52 would imply that the bearish momentum has taken charge and will attract some follow-through sellers. The RSI indicator has skewed to the south, signaling that the breakout is possible.

Resistance: 136.52, 137.06, 137.61

Support: 136.84, 134.75

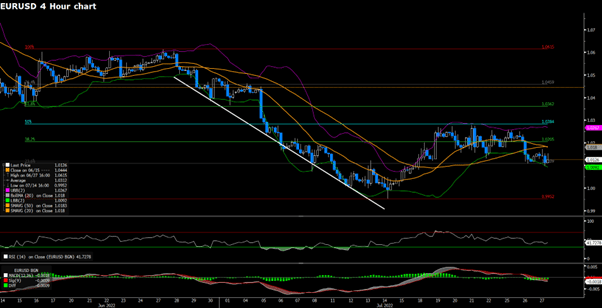

EURUSD (4-Hour Chart)

EURUSD lost traction in the second half of the day on Wednesday as the greenback recovers ahead of the FOMC meeting. From the technical perspective, EURUSD currently trades slightly above the support of 1.0109. The pair has been oscillating in the range of 1.0109-1.0284 since mid-July. Whether EURUSD can hold above the support level would be a turning point to determine the momentum of the pair. If EURUSD falls below the support, then it will attract some follow-through sellers, causing the pair to move further south. The RSI continues to trade within the negative territory, implying that buyers are still on the sideline.

Resistance: 1.0205, 1.0284, 1.0362

Support: 1.0109, 0.9952