US stocks advanced higher on Friday, witnessing impressive daily gains and preserving their bullish momentum amid the risk-on market sentiment. The markets seem to have priced in a supersized 75 bps rate hike at the September FOMC meeting as the bets for aggressive monetary tightening were reaffirmed by Fed Chair Jerome Powell, who said on Thursday that the Fed needs to keep going until it brings the inflation down.

Looking ahead, markets will be focused on the August consumer-price index that will be released this Thursday, which is seen as one of the key reports before the Fed rate decision on September 20-21. In the Eurozone, hawkish comments from ECB officials provided a boost to the euro, as ECB policymaker Peter Kazimir and Klaas Knot said that their priority was policy normalization and added that they had no other option than to continue with resolute rate hikes. The ECB’s 75 bps rate hike announcement has also trimmed the Fed-ECB policy divergence.

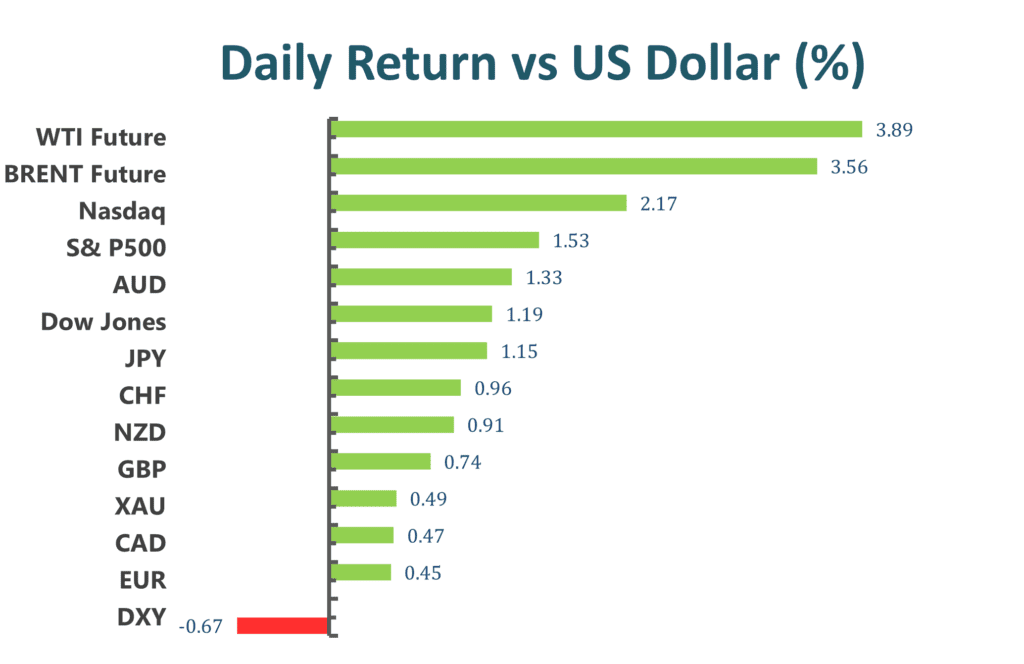

The benchmark S&P 500 and Dow Jones Industrial Average both gained positive traction on Friday as the S&P 500 topped its 100-day average and snapped a three-week losing streak. The S&P 500 was up 1.5% on a daily basis and the Dow Jones Industrial Average also advanced 1.2% for the day. All eleven sectors in the S & P 500 stayed in positive territory as the Communication Services and the Energy sectors are the best performing among all groups, rising 2.53% and 2.38% respectively. The Nasdaq 100 meanwhile climbed the most with a 2.2% gain on Friday and the MSCI World index was up 1.7%.

The US dollar suffered daily losses on Friday, coming under heavy selling pressure and retreating further from a two-decade high near the 110 mark amid the risk-on impulse across the board. However, the aggressive Fed rate hike bets and elevated US Treasury bond yields should help limit any meaningful US dollar corrective slide. Market focus now shifts to US CPI data as a consecutive decline in the headline report will confirm that the inflationary pressures are responding inversely to the higher interest rates by the Fed.

GBP/USD surged on Friday with a 0.75% gain as Cable caught aggressive bids and climbed to near a two-week high amid broad-based US dollar weakness. On the UK front, UK’s new Prime Minister Liz Truss’ plans to cap energy bills for the next two years continued to provide support to Cable. Meanwhile, EUR/USD also advanced sharply and touched a daily high above the 1.010 mark in the early European session. The pair was up almost 0.50% for the day.

Gold advanced higher with a 0.50% gain for the day after touching a daily high above the $1728 mark during the European session, as the falling US dollar helped the safe-haven metal to find demand. Meanwhile, WTI Oil staged a goodish rebound and refreshed its daily top above the $87 mark during the US trading session, as Russia’s threat to cut oil flows has raised concerns about tight global supply.

Technical Analysis:

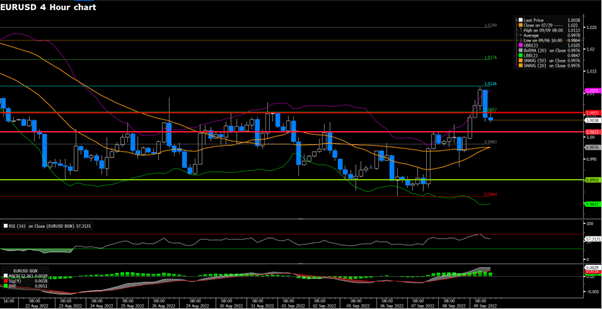

EURUSD (4-Hour Chart)

EURUSD surged during early trading of the Asian trading session. ECB president Christine Lagarde’s remarks on Friday provided some comfort for Euro bulls after the substantive ECB 75 basis point interest rate hike. President Lagarde pointed out that quantitative tightening would not be a norm moving forward. Furthermore, the ECB’s stance remains focused on policy normalization. The weaker U.S. Greenback on Friday allowed Euro bulls to bid EURUSD above parity in more than three straight trading sessions. On the economic docket, the U.S. will release CPI and PPI figures on Tuesday and Wednesday. EU CPI data is scheduled to be released on the 16th.

On the technical side, EURUSD broke above our previously estimated resistance level at 1.0011, but we project this level to hold for the near future. Support level remains at 0.9902. RSI for the pair sits at 49, as of writing. On the four hour chart, EURUSD is currently trading below its 50, 100, and 200-day SMAs.

Resistance: 0.9902, 1.0011, 1.0055

Support: 0.9902, 0.985

GBPUSD (4-Hour Chart)

Cable advanced strongly during the early trading hours of the Asian trading session. GBPUSD was able to cling on to daily gains during the American trading session. U.K.’s new Prime Minister Liz Truss announced a two-year energy price guarantee that would put a ceiling on household energy bills. The bill is expected to cost British taxpayers more than 20 billion Pounds down the road. The weakened Dollar further allowed the Pound to advance. On the economic docket, the U.K. is set to release GDP figures and Manufacturing Production figures on the 12th , CPI data on the 14th , and the BoE is scheduled to announce its interest rate decision on the 15th. However, due to the passing of Queen Elizabeth II, Britain’s public sector could be affected and report dates could be postponed.

On the technical side, GBPUSD climbed to a weekly high of 1.164 during the European trading session but faced resistance soon. A new short term support level for Cable sits at around the 1.15584 price level. Long term support for GBPUSD sits at 1.1463. RSI for the pairs sits at 57.72, as of writing. On the four hour chart, GBPUSD currently trades above its 50, 100, and 200-day SMAs.

Resistance: 1.1561, 1.1854

Support: 1.1463

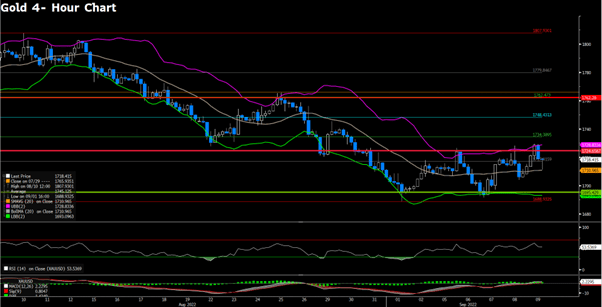

XAUUSD (4-Hour Chart)

The non-yielding yellow metal advanced slightly amid a weaker U.S. Greenback. After touching its two-decade high, the Dollar index retreated below the key 110 level. Short-term selling of the U.S. Greenback is not likely to become a pattern as the Fed remains hawkish and is willing to increase the pace of tightening. Expectations of a 75 basis point interest rate hike by the Fed during the next FOMC have increased significantly after the better-than-projected jobs data released during the previous week. The 13th and 14th could be volatile for XAUUSD as the U.S. is set to release CPI and PPI figures, which are both key indicators for the Fed’s rate hike considerations.

On the technical side, XAUUSD has touched our previously estimated resistance level at the $1762 per ounce price level and began retreating. Short term support level for the precious metal remains at $1688 per ounce. RSI for the pair sits at 43.71, as of writing. On the four hour chart, XAUUSD is currently trading below its 50 ,100, and 200-day SMAs.

Resistance: 1762, 1800

Support: 1688.129, 1695