Market Focus

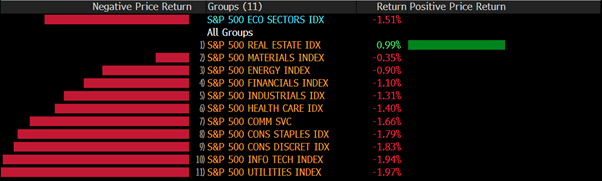

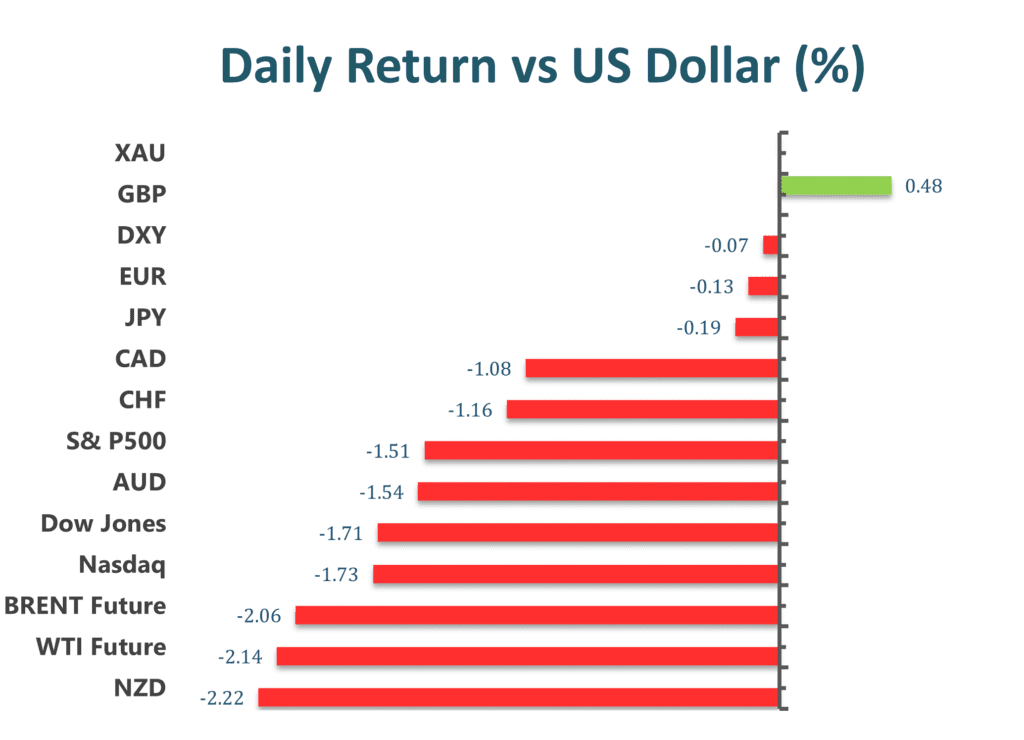

U.S. equities continued to edge lower on the last trading day of the week. The benchmark U.S. 10-year Treasury yield recovered above 3.8% as short term interest rate expectations continue to rise. The Dow Jones Industrial Average lost 1.71%, the S&P 500 slid 1.51%, and the Nasdaq composite lost 1.51%. U.S. equities have suffered their worst monthly performance since March of 2020 after the initial impact of Covid-19. However, the markets are set to head lower as the Fed gears up for further interest rate hikes before the end of the year. The U.S. PCE price index came in at 0.6%, compared to market expectations of 0.1%, signaling a continued upward trend in the price of personal consumption goods.

The cryptocurrency market has been ravaged by the series of interest rate hikes by the Fed and the resulting surge of the Dollar. Bitcoin briefly edged past the $20,000 price level on Friday, but remarks from Federal Reserve vice chair Lael Brainard triggered another drop amid another hawkish signal.

WTI edged below $80 a barrel by Friday’s close. The Dollar-denominated energy commodity has struggled to attract demand as the global economic outlook continues to worsen. Brent crude was last seen trading at around $85 a barrel.

Main Pairs Movement:

The Dollar index posted weekly losses for the first time since the first week of September. The downward trending U.S. Greenback has allowed breathing room for most foreign pairs against the Dollar. EURUSD rose 1.17 % over the course of last week, GBPUSD rose 2.81% over the course of last week, and Gold rose 1.04% over the course of last week. However, with at least two more interest rate hikes planned before the end of the year, the Federal Reserve’s hawkish tone and dollar strength are not to be challenged.

USDJPY witnessed a 0.99% gain over the course of the previous week, despite a broadly weaker Dollar. The Japanese Yen has continued to devalue against the Dollar, as there seems to be no immediate plan for the Japanese central bank to intervene in its exchange rate. However, with Japan opening its borders in October, tourism and higher passenger pass-through rates are expected to stimulate organic growth in Japan.

On the economic docket, U.S. PMI data and U.K. PMI data will headline this week’s economic data releases.

Technical Analysis:

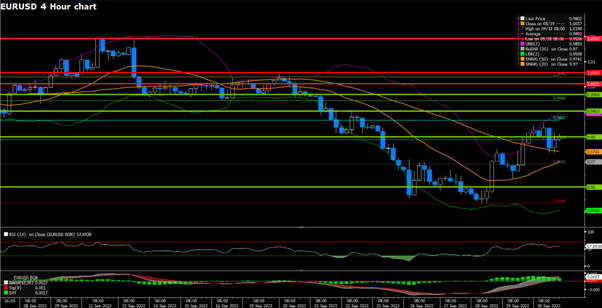

EURUSD (4-Hour Chart)

EURUSD lost 0.15% over the course of the last trading day of the week. Despite a broadly weakened Dollar on the 30th, the Euro still fell against the Greenback as market participants continued to sell the Euro. Eurozone CPI came in at 10%, which is much higher than market consensus of 9.1%. The higher CPI in the EU confirms fears over the ECB’s ability to rein in inflation. However, German unemployment change did come in at the market estimate of 14K. On the economic docket, the ECB is set to announce its interest rate decision during the European trading session of the 6th.

On the technical side, EURUSD has continued to consolidate around our previously estimated support level of 0.98. Despite a 0.7% loss over the course of last week’s trading, EURUSD has continued to head upwards towards parity. RSI for the pair sits at 48.3, as of writing. On the four hour chart, EURUSD is currently trading above its 50 day SMA but below its 100 and 200 day SMAs.

Resistance: 1.0011, 1.0055

Support: 0.98, 0.96

GBPUSD (4-Hour Chart)

Cable extended its recovery over the course of Friday’s trading. The broad based sell off of the Dollar has aided the Pounds recovery during Friday’s trading. After Wednesday’s decision by the BoE to intervene in the Gilt market, in order to stop Sterling’s freefall, GBPUSD has recovered more than 4% to trade above 1.116. On the economic docket, the U.S. is set to release its ADP nonfarm employment change and non- manufacturing PMI on the 5th, while Britain will release its manufacturing PMI on the 3rd. On Friday, the U.S. will release its monthly unemployment rate figure.

On the technical side, GBPUSD has found new resistance at our previously estimated resistance level at 1.12. Short term support level for the pair remains firm at 1.08. Long term resistance for Cable stands at around the 1.1371 price level. RSI for the pair sits at 30.67, as of writing. On the four hour chart, GBPUSD is currently trading above its 50 day SMA but below its 100 and 200 day SMAs.

Resistance: 1.1561, 1.1854

Support: 1.08, 1.053

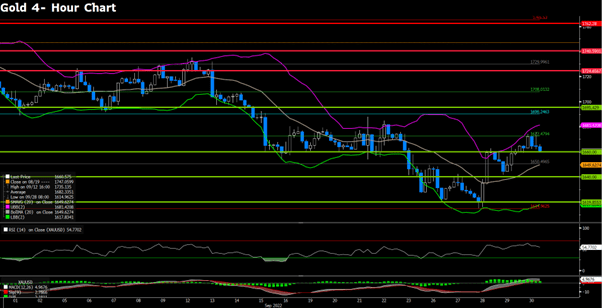

XAUUSD (4-Hour Chart)

The Dollar denominated gold traded mostly sideways over the course of the last trading day of the week. The non-yielding metal, however, gained over 1% over the course of the previous week amid the Dollar’s cool off. Russia’s escalation of actions towards Ukraine and the mysterious sabotage of the Nord Stream 1 pipeline have both exacerbated market volatility and the demand for Gold. While Gold has not been performing well under current interest rate conditions, uncertainty and rising risk due to geopolitical confrontations have supported the recent recovery rally of the Dollar-denominated Gold.

On the technical side, XAUUSD has met short term resistance at above the $1670 per ounce price region and has resumed trading at our previously estimated support level for the pair at $1660 per ounce. RSI for the pair sits at 38.32, as of writing. On the four hour chart, XAUUSD is currently trading above its 50 day SMA but below its 100 and 200 day SMAs.

Resistance: 1695, 1724

Support: 1660, 1640