Always wanted to trade crypto but have no idea where to start? Build your foundation of these digital currencies and learn how you can take advantage of their volatility.

Content:

- What are Cryptocurrencies?

- Bitcoin and Ethereum

- How to Trade Cryptocurrencies

- How to Analyse Cryptocurrencies

- Trading Cryptocurrency CFDs

1. What are Cryptocurrencies?

In simplest terms, cryptocurrencies are decentralised assets built on blockchain technology – a virtual, publicly-distributed ledger of information. They are digital or virtual currencies whose transaction information is distributed across a large network of individual computers or databases. Theoretically, this makes them immune to interference or manipulation. For example, a central bank cannot decide to suddenly “print” more crypto, or coin’s supply cannot be increased beyond mining – unlike with fiat currencies, where the money supply can be increased as a central bank sees fit.

A relatively new technology and an even newer asset class, Cryptocurrency has experienced both explosive growth and spectacular crashes. Due to its extreme volatility, nascent regulation, and status as a new, potentially disruptive technology, they offer tremendous opportunities for investors that can stomach the risk.

2. Two Major Cryptocurrencies: Bitcoin and Ethereum

The two largest cryptocurrencies by market cap and daily trade volume, Bitcoin and Ethereum both have their own unique characteristics and functions.

What is Bitcoin?

The first blockchain and coin, Bitcoin (BTC) has seen a meteoric rise from having practically no value, to a largely-celebrated milestone of hitting dollar parity in 2011, to hitting a peak of US$69,000 in November 2021.

Launched in 2009 via a whitepaper by the mysterious Satoshi Nakamoto, Bitcoin was originally proposed as a virtual, decentralised currency that could safely enable peer-to-peer transactions without the need for a trusted third party. While its price has since gone up by magnitudes, bitcoin has not seen much functional use beyond as a currency. It has evolved to be something like the gold of crypto: a relatively stable store of value with limited supply.

Bitcoin is created through mining, where miners contribute computing power to solve cryptographic problems in order to validate transactions made on the bitcoin network. In return, miners are rewarded with bitcoin. However, the more bitcoins are mined, the more computing power is required to mine it. Additionally, the rewards for mining are halved roughly every four years in an event called the Bitcoin halving – a feature that was written into Bitcoin’s algorithm to counteract inflation. In this aspect, Bitcoin is more reliable than gold because we know for sure how much Bitcoin there is that is yet unmined (below-ground gold is only an estimate), and the scarcity of Bitcoin is also guaranteed.

What is Ethereum?

Ethereum is a blockchain that takes Bitcoin’s idea of an immutable, distributed ledger to allow people to build apps on it. If Bitcoin is analogous to gold, then Ethereum is the silver of cryptocurrencies: worth less per unit, but has many more functional applications. Created by Vitalik Buterin in 2014 as a platform to build decentralised applications upon, Ethereum features a more robust programming language that would give more power to developers. Since its founding, Ethereum has exploded in an endless number of applications: from gaming to Decentralised Finance (DeFi), to Non-Fungible tokens (NFTs).

Unlike Bitcoin, the supply of Ethereum is unbounded, meaning there is technically no limit on how much Ethereum can be mined, although there is a yearly cap of 18 million ETH per year. This is, as outlined in Ethereum’s whitepaper, to reduce the risk of the excessive wealth concentration seen in Bitcoin. There is also no halving in Ethereum. Instead, members of the community vote on Ethereum Improvement Proposals (EIPs) to decide on proposed changes, including the rewards for mining.

Because of all the above factors, Ethereum is generally seen as having more functional potential than Bitcoin even though it does not have first mover status. For example, Ethereum’s move to a proof-of-stake model (widely dubbed Ethereum 2.0) will vastly improve processing speed and make it more eco-friendly. In fact, many bulls think that it is only a matter of time before Ethereum overtakes Bitcoin as the largest cryptocurrency by value. As of September 2022, this forecast isn’t far off with a $203 billion market cap for ETH and $380 billion for BTC.

3. How to Trade Cryptocurrencies

Price movements on cryptocurrencies like Bitcoin or Ethereum are driven primarily by the news and prevailing sentiment, which can lead to massive intraday price swings, making cryptocurrencies exciting products for aggressive and experienced day traders.

What influences the price of crypto?

Because Cryptocurrencies are such a new asset class, information about their price movements is not as well-studied as long-existing markets like FX, stocks, or gold. Historical data goes back less than a decade, so there is much uncertainty about how they react to market forces or cycles. However, patterns have already begun to emerge.

In the early days, many saw Bitcoin as analogous to gold as a hedge against inflation, something whose value would move independently from fiat currency. However, as investors started entering the market in droves in 2017, crypto has become increasingly integrated into the impossibly complex machinery of the global financial markets.

These days, most cryptocurrencies, especially Bitcoin and to a lesser extent major altcoins like Ethereum, move according to risk sentiment in the markets – just like most instruments.

While Bitcoin has the same hard money properties as gold (both have a limited supply and get exponentially difficult to mine as the supply goes up, are liquid assets, and have a baseline value), it is currently considered by investors to be a risk-on asset that is more correlated with growth or tech stocks.

What time is crypto traded?

Because cryptocurrencies are decentralised across a network of computers around the world, they are traded 24/7. This is unlike the foreign exchange market, which, while also decentralised, is traded 24/5 due to being decentralised across time zones.

Even then, liquidity for this asset has its ups and downs. Analysts have found that BTC spot volumes have become correlated with the US equities market hours (16:30 – 23:00; GMT+3) as Wall Street becomes increasingly involved with crypto.

While there is trading on the weekends, the market tends to be sparse and prone to larger price swings, while spreads tend to be wider. Because of this, some believe that traders should “never trust” movement on the weekends.

Interested in trading BTC or ETH? Sign up with PU Prime today to trade under some of the best conditions around.

Cryptocurrency Quotes

Even though regulators have not made up their minds about whether cryptocurrencies are currencies, securities, or commodities (Bitcoin and Ethereum are currently labelled as commodities, although regulators are still discussing their statuses), they are quoted as currency pairs. For example, quoting the price of Bitcoin in USD would be:

BTC/USD = 19,101.30

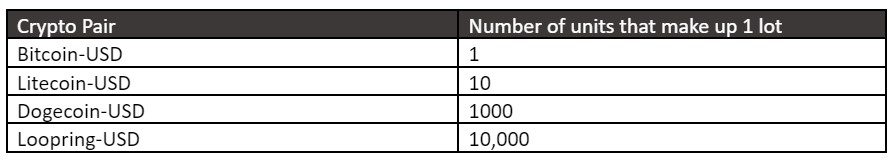

However, because coins vary wildly in terms of magnitude of their dollar values (i.e 1 BTC = US$19,000; 1 SOL = $33; 1 DOGE = $0.066), the contract size for each coin can differ – unlike the standard FX lot of 100,000.

For example, these are the contract sizes of the following products that PU Prime offers for trading:

4. How to Analyse Cryptocurrencies

Fundamental Analysis

Fundamental analysis of crypto includes looking at the following:

Liquidity

Just like any asset, trading crypto successfully requires liquidity. This is the ability for a cryptocurrency to be converted into another cryptocurrency, fiat, or asset. This not just ensures that you will be able to buy or sell at a quoted price, but also that any trades won’t immediately cause outsized volatility. While trading volume is often an indication of liquidity –the higher the volume the more solvent an asset usually is – it is not a true reflection as trading volume only measures the trades that have happened.

This is also an indication of the amount of buying or selling a cryptocurrency can take without moving the needle when considering all the orders on the books.

Market Capitalisation

Like stocks, the market capitalisation (or market cap) is the cash value of all the coins that have been mined. Its value is calculated by multiplying the number of coins by the current price of the coin. Cryptocurrencies with larger market caps are usually seen as more stable, as they have enough heft to weather volatility like in the case of a large cash-out.

Because the crypto market has no circuit breakers like in the stock market, a large downswing in a coin’s prices can cause panic and feed into itself, causing a rapid crash – sometimes to nothing. While small-caps are the most susceptible to this, it can also happen to large projects like the now-bankrupt Terra.

Functionality

Most cryptocurrencies aren’t just static assets. They are tokens associated with a wider blockchain, app, or project and usually have planned or ongoing functionality associated with them. This information can usually be found on a crypto’s White Paper [link]. For example, the Basic Attention Token (BAT), which is built on the Ethereum blockchain, is being used as the currency in the digital advertising ecosystem and facilitates exchange between advertisers, users, and publishers. Cardano, the largest proof-of-stake blockchain, also has its own internal coin, ADA.

Energy Efficiency

While proof-of-work blockchains like Bitcoin consume a notoriously large amount of energy, other cryptos tout themselves as being (relatively) eco-friendly – including Cardano, Solarcoin, and Bitgreen. Better energy efficiency not only means a lower cost of usage. At a time when Environmental, Social, and Governance (ESG) investing is at the forefront of investors’ minds, energy consumption is another consideration that investors consider.

Ecosystem Diversity

Ethereum, the world’s second-largest crypto by market cap, has the most developers working on its blockchain. Its ecosystem includes a large number of DeFi projects, as well as projects pertaining to everything including infrastructure, storage, scaling, privacy, and gaming.

Therefore, how sound, useful, or revolutionary the underlying tech of cryptocurrencies can influence their value. For example, news of Cardano’s hard fork, a tech update called Vasil, boosted ADA’s price.

Government Regulations

While being decentralised is core to crypto’s identity, it would be foolish to assume that this means they are priced independently from decisions made by governments. The digital currency’s immaturity, volatility, and propensity for abuse (especially for scams and money laundering) mean that governments cannot wait to regulate it.

This, in turn, can drastically affect the prices of all cryptocurrencies. For example, China’s ban on the digital asset in September 2021 wiped out $400 billion from the industry virtually overnight. On the flip side, government regulation can also be bullish news as they bring some certainty and stability to an otherwise turbulent industry. For instance, Bitcoin saw a rebound on the back of new US legislation, the Responsible Financial Innovation Act.

Technical Analysis (TA)

Because technical analysis assumes that all fundamentals are reflected in the price action, TA for crypto is the same as with any other instrument. However, this is largely more true for highly liquid, relatively more stable coins like BTC or ETH. It would be risky and unwise to apply TA to highly volatile and low market-cap altcoins whose prices can swing wildly from one minute to the next.

Popular technical analysis tools like the Bollinger Bands, Fibonacci Retracement, and Moving Averages are all used. There are also coin-specific indicators that people have built, like the Bitcoin Fear and Greed Index, which combines volatility and market volume with sentiment-based variables like social media hashtags and google trends.

Other indicators specific to Bitcoin include the Bitcoin Dominance Index, which measures the ratio of Bitcoin’s market cap against the total cryptocurrency market cap. The BTC Dominance Index is used to determine buy or sell signals for either BTC or altcoins since most altcoins follow Bitcoin’s movements.

However, because there’s little price history for these assets, it is difficult to do backtesting for trading strategies involving cryptocurrencies and their derivatives.

For more in-depth information, head to the PU Prime Trading Knowledge guide to Technical Analysis.

5. Trading cryptocurrency CFDs

Trading cryptocurrency Contract for Differences (CFD) has become increasingly popular as traders do not need to take physical delivery of the underlying asset, nor need to go through the process of setting up a wallet.

This posts several benefits. For one, trading CFDs eliminates the risks of a hacker stealing your crypto from an exchange or wallet. A broker like PU Prime, which offers crypto products alongside FX, indices, commodities, and others, also means that you can trade a wide variety of asset classes all from the same account – making the management of your capital much more convenient.

Trading crypto on a platform like PU Prime also gives investors the ability to use leverage, which, while increasing the risk, can potentially amplify any gains.

FAQs

What exactly are cryptocurrencies and how do they work?

In simple terms, cryptocurrencies are digital currencies that are decentralised. They work on blockchain technology, where a distributed ledger enables secure, automated transactions without the need for a trusted third party.

What is the purpose of a cryptocurrency?

Cryptocurrencies have many uses, from enabling secure online payments to having an asset that is free from censorship – like having your bank account frozen by the authorities. In developing countries with unstable economies, cryptocurrencies can be a tool to overcome the lack of financial services, or hyper-inflating fiat currency.

What are the most popular cryptocurrencies?

Bitcoin and Ethereum are the two largest and liquid cryptocurrencies. However, other alt-coins like Cardano, Solana, and even Dogecoin have sizable market caps and trading volumes.

How do you mine for Bitcoins?

Bitcoin is mined using a dedicated setup called a mining rig. These are usually computers with powerful GPUs or an application-specific integrated circuit (ASIC), a powerful, mining-specific piece of hardware.

How much can you earn mining Bitcoins?

Whether it is profitable to mine bitcoin is based on the price of hardware, energy, and the current value of bitcoin.

Ready? Sign up with PU Prime today to trade one of the largest crypto selections among brokerages.